Level Up Your Cash Flow: Tips & Tools to Boss Your Budget

In our journey towards financial freedom, one of the most pivotal steps is understanding and managing our cash flow effectively. Yet, for many, the mere thought of budgeting can invoke feelings of restriction and overwhelm. If you've ever found yourself questioning how to navigate your finances without feeling constrained, you're not alone. Anyone who follows me knows that I don't use the word 'budget'; it is the first thing I remove from my clients' vocabulary and replace it with 'cash flow'. Today, I want to introduce you to a fresh approach to managing your cash flow—one that feels empowering, expansive, and yes, even fun!

But before we delve into the practical tips, let's address something crucial: acceptance of your current financial reality. It's okay to acknowledge where you are right now, without judgment or shame. In fact, acceptance is the first step towards meaningful change. So, take a moment to breathe and reflect on your financial situation. Are there debts weighing you down? List them out, from mortgages to credit card balances. Embrace this awareness with compassion, knowing that it's a necessary part of your journey towards financial empowerment.

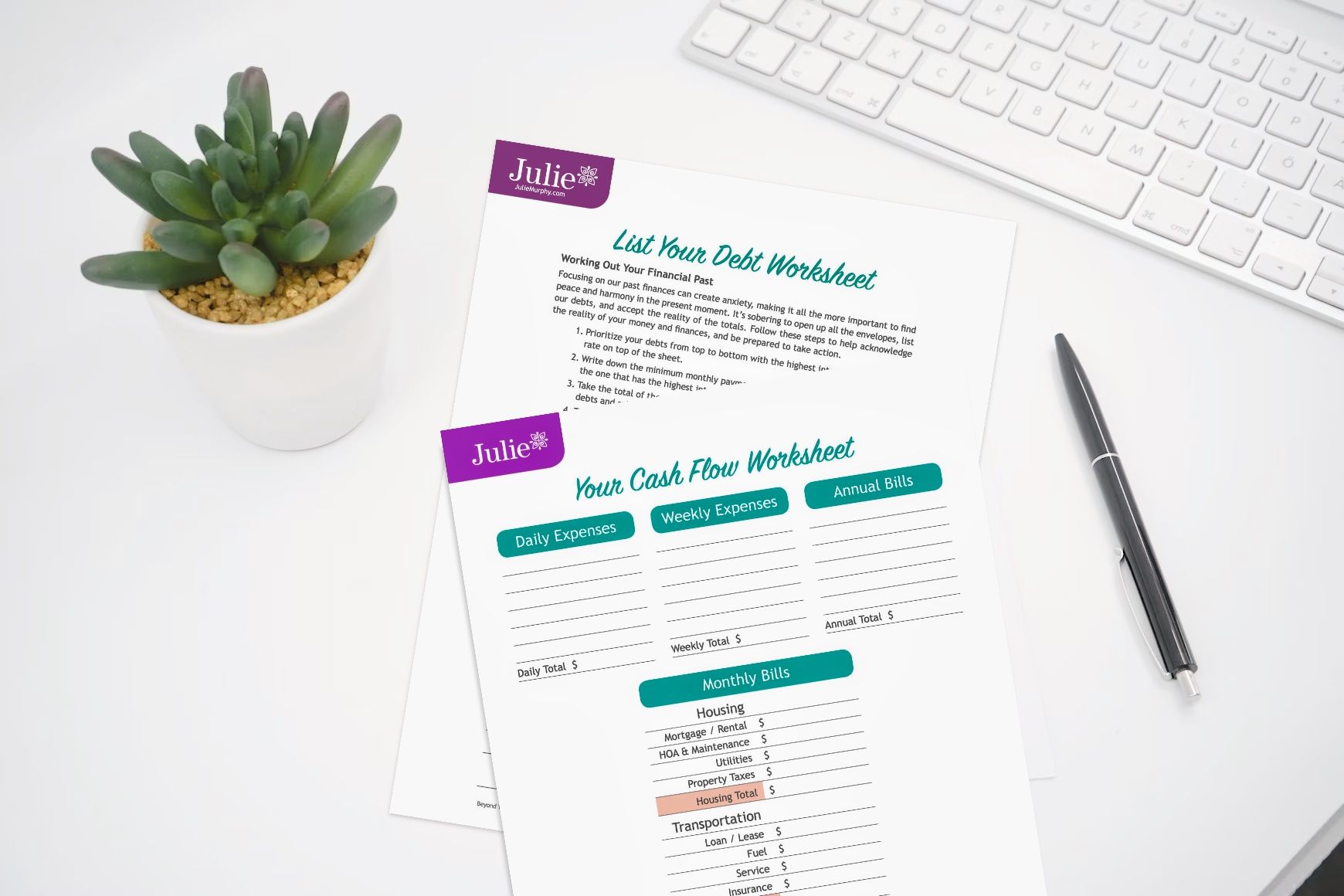

Now, let's shift our perspective from traditional budgeting to a more fluid approach: cash flow management. Rather than viewing it as a rigid system of limitations, think of it as directing the flow of your money in alignment with your goals and values. To help you with this process, I've created a free Debt and Cash Flow Worksheets, designed to guide you through a comprehensive assessment of your finances.

Firstly, let's focus on your current income. Write down the exact amount that gets deposited into your account each month. Next, map out your expenses, distinguishing between fixed (e.g., rent, utilities) and variable (e.g., groceries, entertainment). This level of awareness empowers you to make conscious choices about where your money goes.

Now, let's address any debts. List them out, no matter how daunting they may seem. Remember, acknowledging them is the first step towards overcoming them. With each debt listed, breathe into any resistance or discomfort you may feel. Acceptance paves the way for transformation.

As you work through the worksheet, you'll gain clarity on your financial situation and identify areas where you can make adjustments. Perhaps you'll uncover subscriptions you no longer use or find opportunities to reduce your weekly expenses. Every small change contributes to your financial well-being.

But it's not just about managing your finances—it's also about nurturing your relationships. Take a moment to reflect on the dynamics of your relationships. Are there patterns or behaviors that no longer serve you? By recognizing these patterns, you can begin to shift them, paving the way for healthier connections.

Remember, this journey is about progress, not perfection. Embrace each step with compassion and curiosity. And if you ever feel overwhelmed, know that support is available. Together, we can unlock the path to financial freedom and fulfillment.

Ready to take the first step? Download your free Debt and Cash Flow Worksheet.

Share Blog On Social

Recent Blogs

Similar Blogs